How Has The US Economy Remained So Resilient In The Face Of Much Higher Rates? Here Is The Answer

https://www.zerohedge.com/markets/how-has-us-economy-remained-so-resilient-face-much-higher-rates-here-answerSummary:

The markets have been celebrating the killing of inflation without the killing of the economy, but they have popped the champagne corks prematurely.

Disinflation to date has been benign because it has come almost entirely from improving supply.

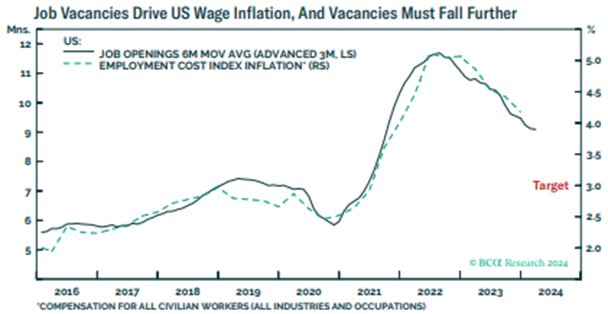

But the supply-side tailwind has exhausted, so the last mile of the journey to

2 percent inflation will be the hardest.

Our bullish structural stance on bonds is intact given Powell’s commitment that “we’re not declaring victory at all at this point, we think we have a ways to go.”

But tactically the bond rally went too far too fast, warranting a neutral stance.

If bonds consolidate, stocks are likely to consolidate too, also warranting a tactically neutral stance.

The markets, and the Wall Street commentariat, have been popping the champagne corks. They have been celebrating the killing of inflation without the killing of the economy. Yet this celebration is premature, at least in the US and the UK.

Through a simple sequence of charts, I will demonstrate that though the journey back to a sustained 2 percent inflation is possible without killing the US economy, it is not yet mission accomplished. The hardest part will be the last mile. I will then make a brief comparison with the UK and Germany.

It is due to job openings and wages. However, that is not sustainable.